stanislaus county tax collector property tax

The County Auditor-Controllers Property Taxes Assessments Division computes the amount of tax due by multiplying the taxable value of the property by the applicable tax rate. See detailed property tax information from the sample report for 4217 Dynasty Ln Stanislaus County CA.

Stanislaus County Superior Court

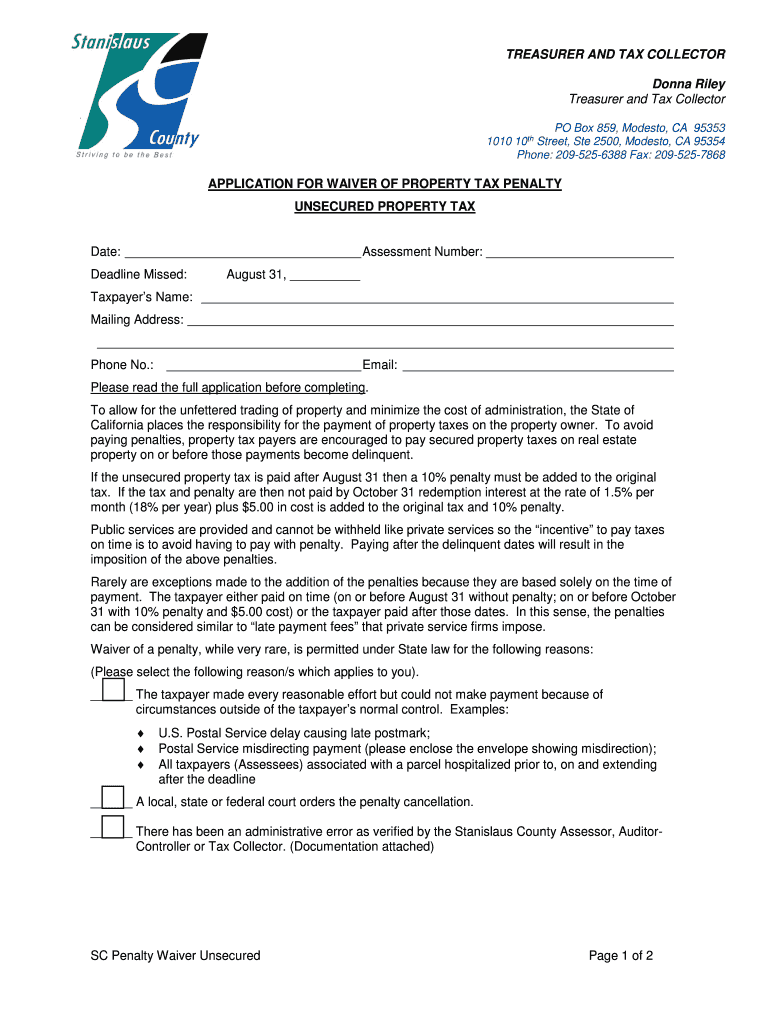

The Stanislaus County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Stanislaus County.

. Make checkmoney order payable to SF Tax Collector. Stanislaus County has one of the highest median property taxes in the United States and is ranked 525th of the 3143 counties in order of median property taxes. Ford Stanislaus County Tax Collector PO Box 859 Modesto CA 95353.

Office of the Treasurer Tax Collector. See reviews photos directions phone numbers and more for County Stanislaus Treasurer Tax Collector Property Tax Bill locations in Hughson CA. If you do not have the stub s list the parcel number s andor address es on a piece of paper and send it with your payment to.

The median property tax on a 28520000 house is 211048 in California. Include Block and Lot number on memo line. 1010 10th Street Ste.

The Stanislaus County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Stanislaus County and may. See reviews photos directions phone numbers and more for County Stanislaus Treasurer Tax Collector Property Tax Bill locations in Salida CA. Proposition 13 enacted in 1978 forms the basis for the current property tax laws.

The median property tax on a 28520000 house is 188232 in Stanislaus County. Please mail early to avoid penalties. Stanislaus County collects on average 066 of a propertys assessed fair market value as property tax.

The tax rate is equal to one percent 1 plus bonded debt for the location of the assessed property. The Stanislaus County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax. To contact our office directly please call 209 525-6461 800 AM to 430 PM.

209 525 6461 Phone 209 525 6586Fax The Stanislaus County Tax Assessors Office is located in Modesto California. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

Stanly County Courthouse 201 South Second Street Albemarle NC 28001 Hours of Operation. The median property tax also known as real estate tax in Stanislaus County is 187400 per year based on a median home value of 28520000 and a median effective property tax rate of 066 of property value. Closed Saturdays Sundays Holidays.

Do not send cash. Get driving directions to this office. The canceled checkmoney order stub serves as your receipt.

The median property tax in Stanislaus County California is 1874 per year for a home worth the median value of 285200. It is the responsibility of the Auditor-Controllers Property Tax Division to allocate and distribute the. The value and property type of your home or business property is determined by the Salt Lake County Assessor.

Monday - Friday 830 am -500 pm Pay by phone 1-888-586-0302. Ad Pay Your Taxes Bill Online with doxo. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Stanislaus County Tax Appraisers office.

Find Stanislaus County Property Records. Stanislaus County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Stanislaus County Property Records are real estate documents that contain information related to real property in Stanislaus County California.

Our website is an ongoing part of my commitment to keeping you informed of your rights and responsibilities as property owners in Stanislaus County. The Tax Collector only accepts the US Postal Service postmark. Residential property owners typically receive a 45 deduction from their home value to determine the taxable value which means you.

1010 10th Street Suite 2500. Stanislaus County Assessors Office Services. As the elected Assessor of Stanislaus County it is my sworn responsibility to uphold the States Property Tax Laws.

Stanislaus County To Conduct First Ever Online Tax Sale On Bid4assets

Candidate Is Unopposed To Become The Da In Stanislaus County Modesto Bee

Fl 300 Request For Order Stanislaus County Superior Court

Ca Application For Waiver Of Property Tax Penalty Unsecured Property Tax Stanislaus County Fill And Sign Printable Template Online Us Legal Forms

Stanislaus County Community Services 401 Paradise Rd E Modesto Ca 95351 Usa

Contacts Treasurer Tax Collector Stanislaus County

Stanislaus Employment Opportunities Stanislaus County

Contacts Treasurer Tax Collector Stanislaus County

Contact Us Elections Stanislaus County

Stanislaus Employment Opportunities Stanislaus County

Best Places To Live In Stanislaus County California

News District Attorney Stanislaus County

Accounts Payable Division Auditor Controller Stanislaus County

Company Rates Stanislaus County In Top 10 Where Property Taxes Go Farthest Ceres Courier

Stanislaus County Juvenile Hall 2215 Blue Gum Ave Modesto Ca 95358 Usa